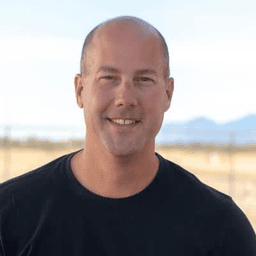

From IT Burnout to Blog Exit: How Steve Adcock Sold Think Save Retire for Six Figures

Business Description

Table of Contents

Navigate through the case study sections

Executive Summary

Case Study Content

Steve Adcock’s Journey: Turning a Personal Blog into a Six-Figure Exit

When Steve Adcock pulled the plug on his 14-year IT career, he wasn’t chasing an overnight fortune, just freedom, purpose, and a place to document his experience. Dissatisfied with his daily grind, Steve recognized his skills could help him break free. In 2014, he launched Think Save Retire as a candid journal of his pursuit of financial independence and early retirement (FIRE). No secret product, no big launch, just one guy ready to tell his story.

No Master Plan, Just Honest Content

Steve admits, launching Think Save Retire was simple: Buy a domain, set up hosting, and start writing about what mattered to him. He didn’t care about SEO, monetization, or even traffic at first. Instead, he focused on publishing thoughtful posts twice a week. His only investment? A few bucks for the domain and hosting, no paid ads, no content mills, not even fancy plugins.

Becoming Part of Something Bigger

Steve knew the value of relationships. The FIRE community, full of like-minded people aiming for financial freedom, welcomed him. He commented on other blogs, started conversations on social media, and contributed guest posts. No spammy comment blasts or hustle culture posturing; just genuine interest and a willingness to connect. Rather than fixate on keyword research, Steve organically built visibility by being a positive, active voice in the niche.

Slow Start, But Real Growth

His first year? All content, zero profit. Think Save Retire wasn’t designed to generate cash overnight. By the end of year two, Steve dipped his toes into affiliate marketing and banners, earning around $50 a month, a side bonus, not the main event. He also built a basic email newsletter, sneaking in affiliate links here and there. Over time, everything grew: tiny profits, modest list, deeper connections. There were no viral traffic spikes, just slow, steady accumulation. By 2017, three years in, the site regularly drew over 100,000 monthly pageviews. All without living at Google’s mercy.

Monetization: Slow, Steady, Sustainable

Affiliate links barely moved the needle, but display ads made a serious difference. Once Think Save Retire reached the right audience numbers, Steve applied to Mediavine, a premium ad network, earning $800-1,000 per month. Ads were hands-off income, earned simply by attracting loyal readers. Eventually, he leapfrogged to AdThrive, another high-performance network, boosting income to $1,200–$1,500 a month. Steve moved fast to lock this in, qualifying, coincidentally, right before a major acquisition offer arrived.

Content by Heart, SEO by Default

Steve refused to churn out robotic, keyword-bloated articles just to please Google. While other blogs tiptoed around the search engine’s changing rules, Steve’s work attracted attention because it wasn’t manufactured for algorithms, it was written to help actual readers. Outside of some very basic SEO (like using an SEO WordPress plugin for titles and image alt text), his posts stayed raw and original. The authenticity resonated, and soon enough, Think Save Retire automatically ranked for competitive search terms anyway.

The Offer That Changed Everything

Think Save Retire was not for sale, that is, until a financial investment firm came knocking. They’d noticed the blog’s strong rankings and steady traffic. Steve, outwardly unphased, played hardball: "I’m not interested, but I could be for the right price." The eventual offer landed in the low six figures, thanks to the site's established keywords and loyal following. Without a strict exit plan, Steve saw the timing was right. After half a decade of content grind, a fresh start and lump-sum payout looked appealing.

A Smooth Transition (and Keeping Integrity)

As part of the deal, Steve agreed to keep writing for six months post-sale. His motivation naturally dipped since the site was no longer his, but he fulfilled the contract. Crucially, the new owners kept the site true to its purpose, retaining all of Steve’s original articles. There was no ugly content chop. The blog, today, remains focused on personal finance and FI/RE.

Consistency and Voice Over Growth Hacks

Steve credits his results to two things: consistency and authenticity. He kept a regular publishing schedule, two new posts each week, plus email newsletters every time. He wrote what mattered to him, not what a search tool said would win traffic. Most blogs chase algorithm crumbs; Think Save Retire built loyalty by serving real people with genuine stories.

Life After the Sale

The windfall from selling Think Save Retire gave Steve more free time and a pad of cash, but didn’t dramatically alter his life, he’d already achieved financial independence. These days, he invests his creative energy building a Twitter presence (making $3,000–$4,000/month teaching social media growth), launching Millionaire Habits (an online personal finance resource), and running FI/Accelerator, a course showing others how to replicate his path to wealth. Steve isn’t driven by need; he finds satisfaction in the game and prefers to be paid for the wisdom he’s gathered.

Lessons for Aspiring Creators

- Start with authenticity and consistency, not trends or flashy tactics.

- Your first year will likely bring little to no profit, be patient.

- Invest your time into real human connections and community over hacks.

- Let monetization follow genuine audience growth, not the other way around.

- Be open to opportunities, even if you’re not explicitly seeking them. You never know when the right buyer will appear.

A Final Word

The story of Think Save Retire is not about overnight riches or secret growth formulas. Steve succeeded because he committed to helping readers, published regularly, and didn't get distracted by shiny metrics. In the content gold rush, it's still possible for honest storytelling and real connection to pay off, in both impact and dollars. If you want to replicate this, don’t just copy the playbook. Use your own voice. Talk to real people. And when the chance comes, don’t be afraid to take it.

Business Plan

Market Problem

Many individuals struggle with the traditional 9-to-5 work life, leading to burnout and a lack of fulfillment. The desire for financial…

See the full market problemSolution

Think Save Retire serves as a beacon for those aiming for financial independence. Through authentic storytelling and community engagement,…

See the full solutionTarget Market

Individuals seeking financial independence

They are looking for relatable stories and practical advice on saving and investing.

Burnt-out professionals

People in traditional jobs wanting to transition to a more fulfilling career path or venture.

Competitors

The Simple Dollar

Focuses on personal finance tips, budgeting, and debt management.

Mr. Money Mustache

Advocates for extreme frugality and smart investing to achieve financial independence.

Competitive Advantage

The primary advantage of Think Save Retire is its authenticity. Unlike many competitors that prioritize SEO or quick monetization, Steve's…

See the full competitive advantageSales and Marketing

To market Think Save Retire, Steve engaged directly with the community through social media and by commenting on other blogs within the…

See the full Sales and marketing planSuccess Milestones

Launch Blog

Set up the domain and hosting, publish the first post focused on personal finance.

Build Community

Engage with other bloggers and readers through comments and social media.

Key Takeaways

- 1Authenticity and genuine connection with the FIRE community fueled Think Save Retire’s growth more than search engine tricks.

- 2Steve Adcock started the blog as a side project while working full-time in IT, with zero expectations of a six-figure exit.

- 3The blog monetized initially through affiliate marketing, but real income came from joining premium ad networks like Mediavine and AdThrive.

- 4Consistent posting (twice weekly) and regular email newsletters helped build a loyal audience and steady, organic traffic.

- 5Steve's refusal to write 'for Google' and focus strictly on community and storytelling set the blog apart in a crowded niche.

- 6A financial firm acquired Think Save Retire, seeing value in its engaged audience and organic keyword rankings, leading to Steve's time/life freedom.

Key Facts

Tools & Technologies Used

Premium Content Locked

Subscribe to access the tools and technologies used in this case study.

Unlock NowHow to Replicate This Success

Premium Content Locked

Subscribe to access the step-by-step replication guide for this case study.

Unlock NowInterested in Being Featured?

Share your success story with our community of entrepreneurs.

Explore More Case Studies

Discover other inspiring business success stories

How Judd Albring Built a $20K/Month YouTube & Email Marketing Business

Chicago dad Judd Albring needed flexible income when he went sober at 35. By 2017 he launched a YouTube channel teaching...

Judd Albring

How Sean Lau Built Three Travel Blogs to Earn $5K Monthly

Sean Lau left his civil engineering career with $20,000 in the bank and a backpack. Over four years he launched Living O...

Living Out Lau

How AYUR Bottle Sold for $38K in 21 Days: Building and Flipping a Wellness Brand Fast

AYUR Bottle transformed a handmade copper bottle concept into a sought-after e-commerce brand that generated balanced re...

AYUR Bottle